Import Regulations in Grenada for Japan Used Cars

Restriction in Number of Years:

No Age Limit

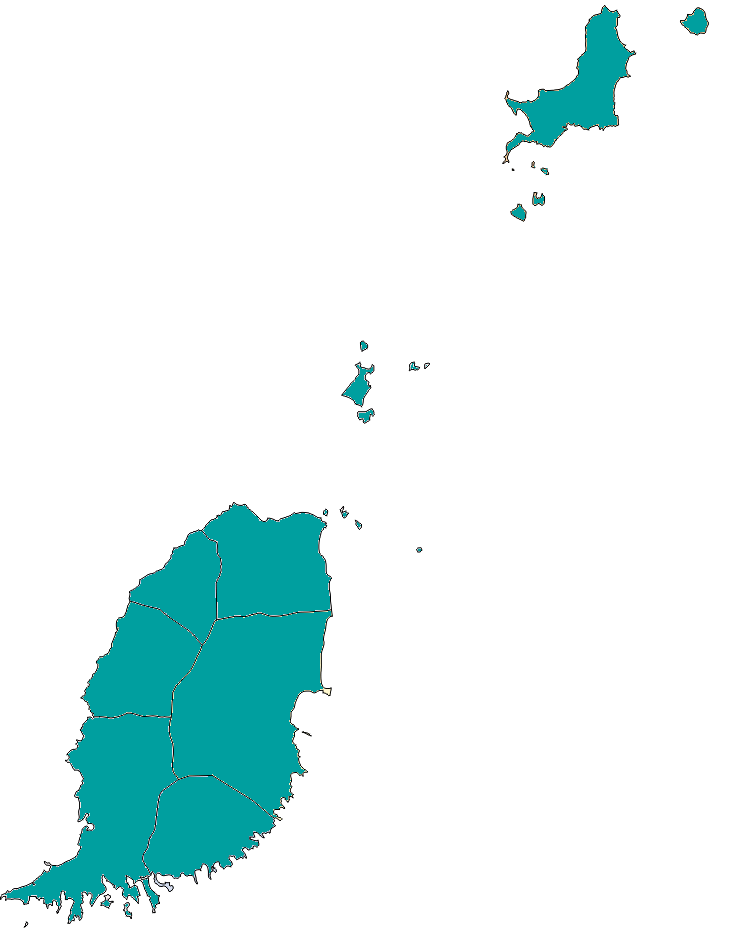

Shipping Ports:

Saint George’s, Grenville

Shipment Time:

RoRo (24-39 Days)

Shipping Schedule:

RoRo (Monthly)

Shipping Line:

NA

Inspection:

No Inspection

Right-hand-drive used Japanese vehicles are permitted for import in Grenada.

DOCUMENTS REQUIRED FOR IMPORT OF VEHICLES

- Bill of Lading

- Freight charges

- Title and Registration certificate

- Tariff Number

- Invoices/ C-22 form

- Insurance certificate

- Import license

- Value Declaration Form

- Customs value

TAXATION

- For the used vehicles that are 1-4 years old, 2% Environmental Levy will be imposed.

- For the used vehicles that are more than 5 years old, 30% Environmental Levy will be imposed.

- 5% Environmental Levy on the used trucks whose weight is 1-10 tons.

- 10% Environmental Levy on the used trucks whose weight is 10-20 tons.

- 20% Environmental Levy on the used trucks whose weight is over 20 tons.

- 5% Customer Service Charge (CSC) will be imposed on the import of Japan used vehicles.

- 5%-40% Common External Tariff (CET) will be imposed on imported vehicles depending on insurance and freight charges.

- 15% Value Added Tax(VAT).

RETURNING NATIONALS

Citizens of Grenada who have lived abroad for 7 years or more and are returning back permanently are considered as Returning Residents.

- Returning Residents are allowed to import one vehicle from Japan without CET, VAT, and ET.

- He/she must have lived in the same country continuously for at least 7 years immediately before returning to Grenada to be able to import the vehicle.

- 6% Customer Service Charge and an Environmental Levy will be implemented on importing new or used Japanese vehicles.

- The returning resident is allowed to sell the vehicle without the payment of duties after 3 years of import.

Returning Residents are required to present the following documents as proof of eligibility:

- Valid passport

- Proof of nationality such as birth certificate, passport, etc.

- A one-way ticket to Grenada

- Retirement letter from the place he/she worked last

- Pension letter

TAXATION AND EXEMPTION IN DUTY FOR RETURNING NATIONALS

- 5% Customer Service Charge and $2000 as Environmental Levy will be imposed regardless of the age of Japan used vehicle.

- Returning residents can not trade, sell, dispose, or give the vehicle away for 3 years unless all the applicable duties and taxes are paid.

- If the necessary duties and taxes are not paid, he/she can sell or trade the vehicle after 5 years.

- If the returning resident has to leave Grenada for 6 months or less, then he/she must inform the Comptroller of Customs regarding the vehicle’s custody.

- If the returning resident has to leave Grenada for 6 months or more, then he/she will have to pay for all the applicable duties and taxes.

- The Comptroller of Customs may provide exemption under special circumstances.